Regulatory Reform

Bank of England aligns Basel 3.1 start date with strong and simple regime

• 0 minute read

July 15, 2025

The Bank of England (BOE) is aligning the start date for its strong and simple regime with the introduction of Basel 3.1 on January 1, 2027, it said on July 15.

The BOE also confirmed a January 1, 2028 start date for firms to begin using its new approach to internal models for market risk. It said it would shortly launch a discussion paper on options for removing barriers that prevent medium-sized firms from using internal ratings-based (IRB) models for residential mortgages.

“Today’s announcements will give certainty to firms of all sizes about the future capital framework, bring in a simpler regime for smaller banks, make it easier for mid-sized banks to scale up in the mortgage market, and allow an extra year for part of the implementation of new investment banking rules,” said Sam Woods, BOE deputy governor and CEO of the Prudential Regulation Authority (PRA).

Ruth Doubleday, head of prudential policy at the Building Societies Association (BSA), welcomed the clarity over the timeline for Basel 3.1 and the strong and simple regime for small domestic deposit takers (SDDT). Final rules for SDDT will be confirmed in the last quarter of 2025.

Previously, building society chiefs have criticised the PRA — including in meetings with the UK Treasury Committee — for applying capital rules intended for globally systemic banks to domestic lenders.

“Aligning the two regimes gives firms the certainty they need to plan,” Doubleday said. “We also welcome the emphasis on supporting the UK mortgage market and growth more generally, and the recognition that more needs to be done to support mid-tier firms that are too large to be SDDT but too small and simple to be systemic.

“We look forward to the discussion paper to help mid-sized banks and building societies to grow through changes to IRB requirements for residential mortgages.” The latter had implications for the government’s agenda to support mutuals and the mortgage market, she added.

MREL

Not everyone was wholly enthusiastic about the announcements.

SeaPoint Insights founder John Cronin, a UK banking sector veteran, said that while the proposals held “a number of positives”, there were also “missed opportunities”.

“Take, for example, the change to the total assets’ threshold in the context of the minimum requirement for own funds and eligible liabilities (MREL) regulations, which has been lifted to a range of £25bn to £40bn, and the decision to maintain the transactional accounts threshold,” he said.

“While this will be welcomed by certain lenders like Paragon Banking Group, it means Metro Bank and OSB Group shall remain subject to these onerous regulations, which only apply to lenders of a much higher size in other jurisdictions.”

The BSA’s Doubleday said that the increase in MREL was a “step in the right direction” but it didn’t fix the problem of the interaction between leverage ratios and MREL for “low-risk building societies”.

“It’s also disappointing to see no change to the indicative thresholds for transactional accounts (40,000-80,000), which mean some SDDT firms could be captured inappropriately,” she said.

In addition to the building societies, the UK’s so-called challenger banks have also repeatedly called for the point at which MREL kicks in to be raised.

Leeds reforms

The BOE announcement was one of a number — collectively dubbed the Leeds Reforms — released ahead of chancellor Rachel Reevesʼ Mansion House speech this evening (Tuesday). Reeves said the package would enable the UK to “double down” on its global strengths and put the country ahead in the “race for financial business” by 2035.

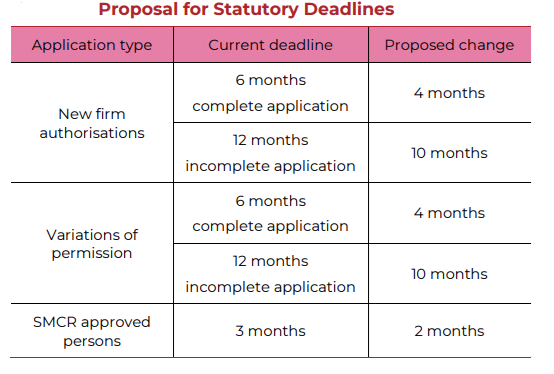

Other proposed reforms include reducing the time the Financial Conduct Authority (FCA) and the PRA have to process authorisation applications (see table), and changing the way in which the regulators’ “have regards” requirements operate.

Challenger banks have also been granted dedicated scale-up support, as requested. The Leeds Reforms included a commitment for firms to be given a point-person at the regulators. This should end what Janine Hart, chief executive of fintech trade body Innovate Finance, described as a “valley of death” in her evidence to the House of Lords Financial Services and Regulation Committee last year.

Both the PRA and the FCA also published consultations on changes to the Senior Managers and Certification Regime (SMCR), alongside a separate consultation from HM Treasury on removing the certification regime from the Financial Services and Markets Act (FSMA).

The government also confirmed it will introduce a standalone regulatory regime for captive insurers by summer 2027, and has published draft statutory instruments (Sis) that would enable the introduction of the Targeted Support Regime for financial guidance. Emma Reynolds, economic secretary to HM Treasury, will also carry out a review into the UK’s ring-fencing regime.

Innovate Finance’s Hirt said the “strong bundle” of reforms will “boost fintech growth in the UK”. The plans to speed up authorisation, overhaul the SMCR and introduce dedicated support to firms scaling up “address barriers identified by our fintech founders and our Unicorn Council and bring to life our proposals for bridging the ‘regulatory valley of death’”, she added.