Compliance

Compliance tops whistleblowing reports to UK FCA, fewer reports lead to ‘significant actionʼ

• 0 minute read

June 24, 2025

The UK Financial Conduct Authority (FCA) received 1,131 protected disclosures in 2024/25 — a slight increase on the 1,124 reports it received in the previous year.

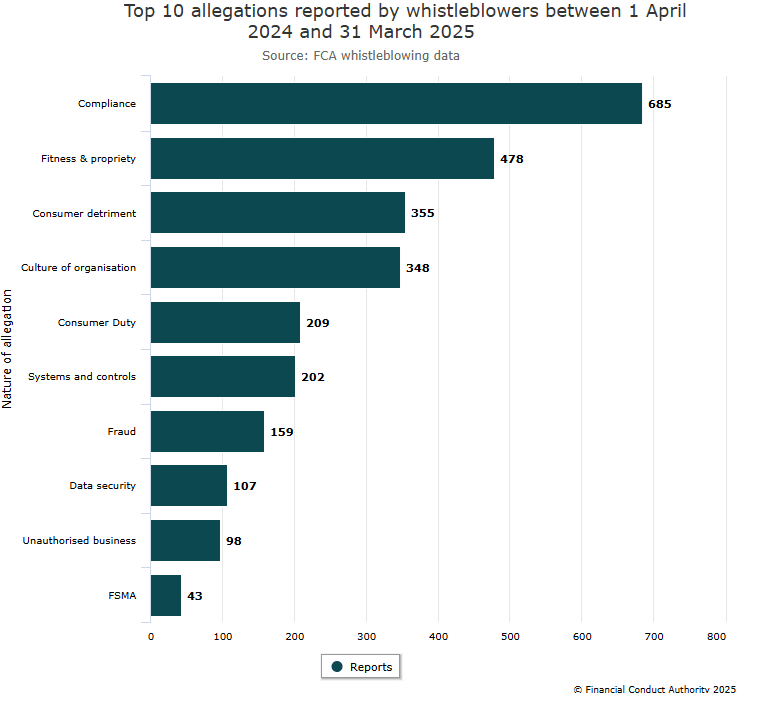

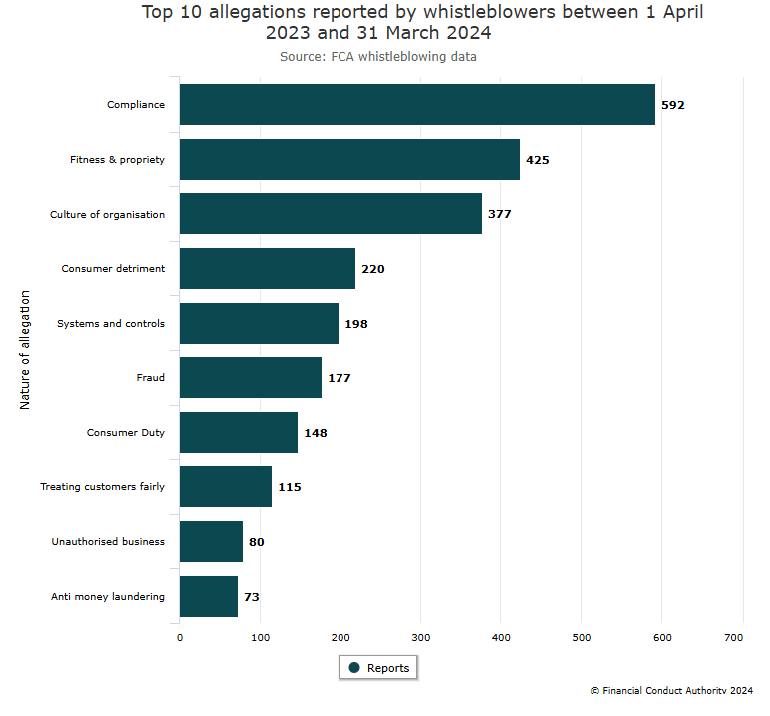

Once again, allegations by whistleblowers about compliance issues at regulated financial firms topped the list of protected disclosures, with 685 reports submitted under this category, up from 529 a year earlier.

However, fewer of the reports closed out by the regulator in the 12 months to March 31, 2025, resulted in “significant action” — 4.6%, compared to 5.8% a year earlier.

The whistleblowing data is contained in the FCA’s prescribed persons annual report published on June 24. It shows that the 1,131 protected disclosures contained 2,684 allegations, as a disclosure often contains more than one reportable concern.

As well as the increase in allegations categorised as compliance, the data also shows a rise in allegations categorised as fitness and propriety, Consumer Duty, systems and controls, unauthorised business, and data security (see tables).

There was a slight dip in allegations categorised as culture and fraud.

Closing out cases

The FCA has a backlog of protected disclosures from 2023/24 and earlier, which it is working through in addition to disclosures it received in 2024/25.

Today’s data set shows that 1,241 of the 1,763 cases closed out in the 12 months to March 31 relate to reports the regulator received in prior years. It does not provide a breakdown of the years in which it first received allegations resolved in 2024/25.

FCA senior executives have publicly committed to improving the feedback they provide to individuals making protected disclosures following criticism it received from whistleblowers in a survey the regulator conducted in 2022. Whistleblowers now receive a letter once the outcome of any investigation into their allegations is completed. The FCA said it had received “positive feedback” from those who have received the new feedback letters and that it continued to look at ways to enhance its’ processes.

Rewarding whistleblowers

HIstorically, the FCA has opposed paying rewards to whistleblowers — unlike the United States, and other jurisdictions, where it is common.

Late last year, however, the regulator changed its stance, as previously reported. According to the annual report, the FCA continues to discuss with “government departments, international partners and industry partners” the potential implications of introducing incentives.

“We recognise the benefits a range of informants can provide in prosecuting criminal offences and we continue to engage actively with other agencies on how this type of intelligence may benefit us in the future,” it said.

The FCA did not provide a timeline for when it will reach a “considered and proportionate” view on incentives.