Social

FCA biennial survey lays bare UK citizensʼ lack of financial resilience

• 0 minute read

May 16, 2025

The UK Financial Conduct Authority’s (FCA) Financial Lives survey has once again highlighted the UK publicʼs lack of financial resilience. It revealed that one in 10 UK-based adults has no savings, while a further 21% have less than £1,000 to call on in an emergency.

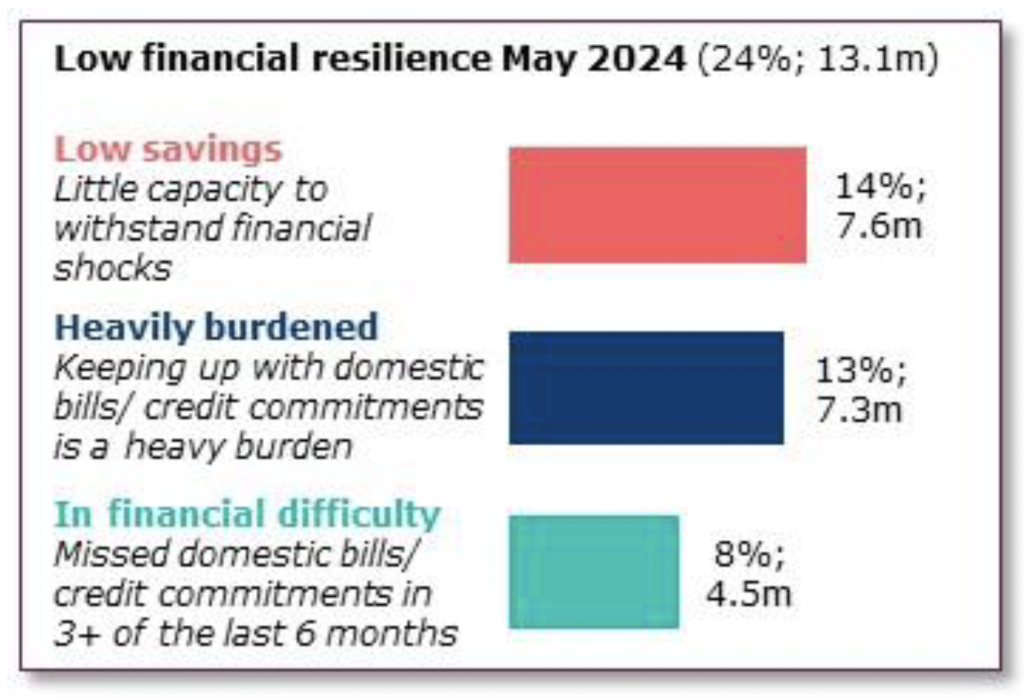

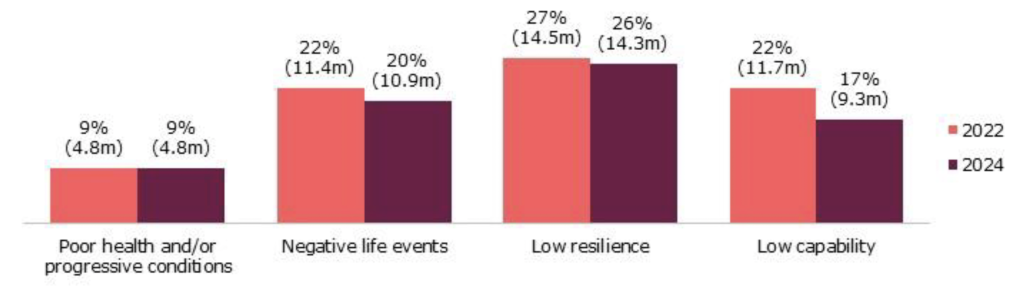

The biennial survey, published this morning but conducted in May 2024, found a quarter people in the UK had low financial resilience — defined by the FCA as having missed a payment; struggling to meet financial commitments or with insufficient savings “to help them through difficulties”.

Further evidence of this lack of resilience can be seen in the finding that some 1.6 million adults had received “support” from their loan or mortgage provider in the past two years.

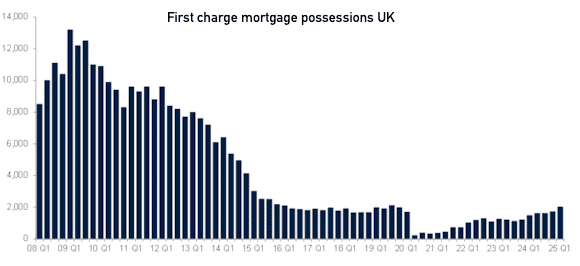

Separate data published earlier this week by trade body UK Finance showed an 18% increase in the number of homes — excluding buy-to-let — being repossessed for mortgage arrears. In all 1,220 owner-occupied properties were taken back by lenders in the first quarter of this year, though this is still significantly below the level seen during the financial crisis.

The regulator said it “encouraged” financial services firms to use the survey findings to “better understand the needs and experiences of their customers and target markets”.

The survey found 92% of individuals with low financial capability felt overwhelmed when they had to interact with providers. They found dealing with customer services on the phone confusing and difficult; didn’t feel able to shop around for financial products; and put off or avoided making financial decisions as a result.

Support gap

The findings also highlight the extent of UK’s financial support gap. Only 8.6% of adults received regulated financial advice in the year to May 2024. An additional 17% of those surveyed used a government-backed guidance service, such as MoneyHelper, Pension Wise or Citizens Advice.

The survey found that 33% of adults with a defined contribution pension have less than £10,000 in their pension pot.

The FCA and the UK government are currently reviewing the advice guidance boundary, which was last redrawn more than a decade ago under the Retail Distribution Review. Twelve financial firms, including online investment platform Hargreaves Lansdown, recently participated in a targeted support sprint as part of the regulator’s boundary review work.

A separate initiative between the charity Citizens Advice and the Centre for Finance Innovation and Technology (CFIT) has successfully piloted a debt advisory initiative that uses smart data to compile standard financial statements. The charity believes it could help an extra 150,000 individuals each year if the service is rolled out nationwide.

The FCA said it hoped the survey data would assist the Financial Inclusion Committee and that it would also support the development of the governmentʼs Financial Inclusion Strategy.

Some progress made

One positive finding was that the number of unbanked UK citizens has dropped, at 900,000 individuals in 2024, compared to 1.1 million in 2022. The rejection rate for people requesting a basic bank account has also declined, with some 4.3 million now having a basic bank account — one million more than in 2020.

The survey also reported that of the 1.7 million people who had sought help from a debt advice or debt management service in the 12 months to May 2024, 61% said their debts were more manageable as a result.

Commenting on the survey’s findings, Sarah Pritchard, executive director of consumers and competition at the FCA, said: “Our data shows that finances are stretched for many, with some unable to save for a rainy day. And we know that some do not have the confidence to invest.

“But there are improvements — more people with current accounts, and less digital exclusion. Our strategy will build on this to help people better navigate their financial lives.”

Protected

One further point of note in the survey findings was that fewer people understand that an FCA authorisation does not guarantee that their money is safe (29% down from 34% in 2022). Or that an FCA authorisation does not mean all the products sold by a firm are approved by the regulator (18% down from 23% in 2022).

The FCA spends around £1.8 million a year on its consumer facing scam smart campaign.