Compliance

FCA CEO says regulator tackling ‘rip-offʼ motor insurance, as Which? mulls super complaint

• 0 minute read

June 5, 2025

Nikhil Rathi, chief executive of the UK Financial Conduct Authority (FCA), said it was focused on reducing harm, in response to a letter on “rip-off” motor insurance practices from Anabel Hoult, the chief executive of Which? The consumer organisation could ultimately issue a super complaint if it believes the regulator is not acting to protect consumers.

Houltʼs letter was accompanied by a petition signed by 170,000 consumers “angry about being ripped-off by their insurers”.

As evidence that the FCA was actively working to ensure fair value for consumers, Rathi cited its 2024 temporary ban on the sale of guaranteed asset protection (GAP) insurance, and its work on tackling the so-called loyalty penalty. “As we’ve shown, we won’t hesitate to act where we find harm and to ensure people receive fair value,” he added.

GAP insurance is taken out as an add-on to car finance, and covers the difference between the value of the car and outstanding debt at the end of the loan agreement. The FCA acted after observing commission rates of 70% on some policies.

The ‘loyalty penalty’ occurred when insurers offered new customers better pricing than existing customers who were renewing their policies. The FCA introduced a remedies package for the practice in May 2021.

Rathi also highlighted the regulatorʼs ongoing reviews of premium finance and claims handling — reports on both will be published this summer — and requirements on firms under the Consumer Duty.

Scepticism

“We welcome the FCA’s Premium Finance Market Study, which we expect to address a clear-cut example of unfair pricing. The FCA’s multi-firm review of insurers’ claims-handling arrangements is also crucially important, as most of the harm we have identified manifests itself when people come to make a claim,” Hoult said.

However, she was sceptical that either review would improve outcomes for buyers of motor insurance.

“If recent FCA reviews investigating compliance with the Consumer Duty in this market are any guide, we fear that they will not result in tangible action to address any identified harms, while consumers continue to suffer,” she said, adding that Which? expected to see the FCA take enforcement action against firms found to have caused harm.

Falling trust

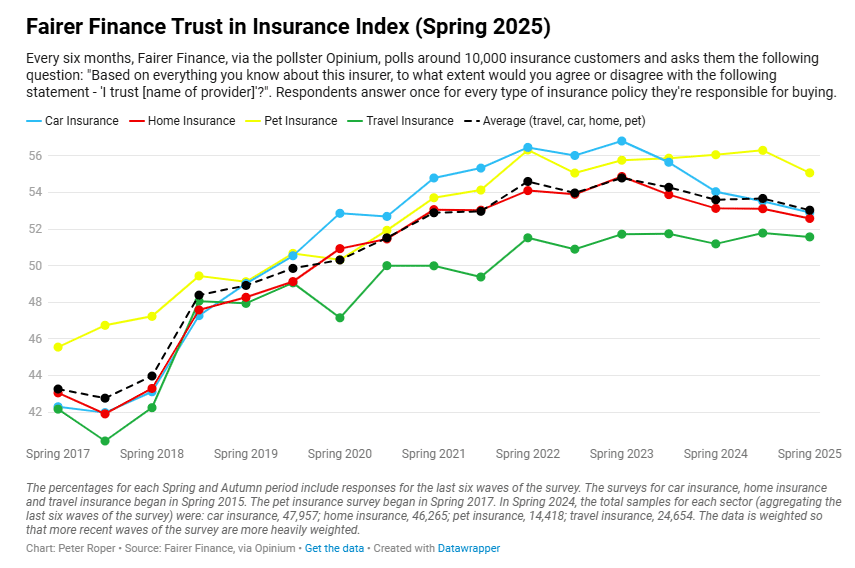

Consumersʼ declining satisfaction with insurers is underscored by the latest trust index from research and rating agency Fairer Finance. Its spring 2025 index, published on June 2, shows a drop in consumer perceptions of the fairness of their insurers across home, motor, travel and pet insurance products.

This reduction in trust comes at a time when insurance premiums for home and car policies have started to drop, after several years of above-inflation rises.

According to the most recent complaints data from the Financial Ombudsman Service, motor insurance is the most complained about insurance product. In the third quarter 2024/25, the ombudsman received 3,660 about motor insurance — 759 of which concerned the administration of policies or providersʼ customer service.

Super complaint

Which? would “use every tool at its disposal” if the current FCA work programme does not result in “tangible action” to reduce harm Hoult said in her letter.

Which? is one of a handful of organisations, including Citizens Advice and the Federation of Small Businesses, who can bring a super complaint to the FCA that requires it to investigate the issue and respond publicly.

In 2016, Which? brought a super complaint on authorised push payment (APP) fraud to the Payment Systems Regulator (PSR), which ultimately led to a change in the law from October 2024 to require mandatory reimbursement by banks of customers who fall victim to APP fraud.