Compliance

FCA takes aim at ‘deceptive design’ practices in online loan market

• 0 minute read

July 31, 2025

The UK Financial Conduct Authority (FCA) has issued a report detailing good and bad practice by online and in-app loan providers, and reminded firms of their Consumer Duty obligation to ensure that customers understand what they are buying.

The FCA believes lendersʼ digital processes could be improved to ensure consumers make informed decisions about their finances. The Consumer Duty requires firms to test their products and track customer complaints so that any problems can be quickly identified and dealt with.

“Poorly designed applications could mean people bypass important information,” Alison Walters, director of consumer finance at the regulator, said on July 31.

Good practice included lenders providing explainer videos and using simplified language, while bias in the layout of applications, a lack of product information and a failure to support vulnerable customers were given as examples of bad practice.

The FCA said design choices in app layouts could “inappropriately exploit consumer biases”, leading to bad outcomes. “In some cases, pre-selected defaults, incentives and the promotion of certain choices can nudge customers towards a particular [poor] decision,” it warned in the report.

Testing and management information were also areas for improvement. With the latter, the FCA found instances where firms failed to act on information indicating their customers were not accessing key product details because they “were advancing too quickly through the customer journey”.

The FCA reminded online loan providers of the interventions it had taken in the consumer credit market over the past decade. It is currently consulting on rules for Buy Now, Pay Later providers, the majority of whose products are accessed at online checkouts.

Sludge and deceptive marketing

Alongside the good and bad practice report, the FCA also published academic research into deceptive marketing, and ‘sludgeʼ practices — described as those that hinder customers from acting in their best interests .

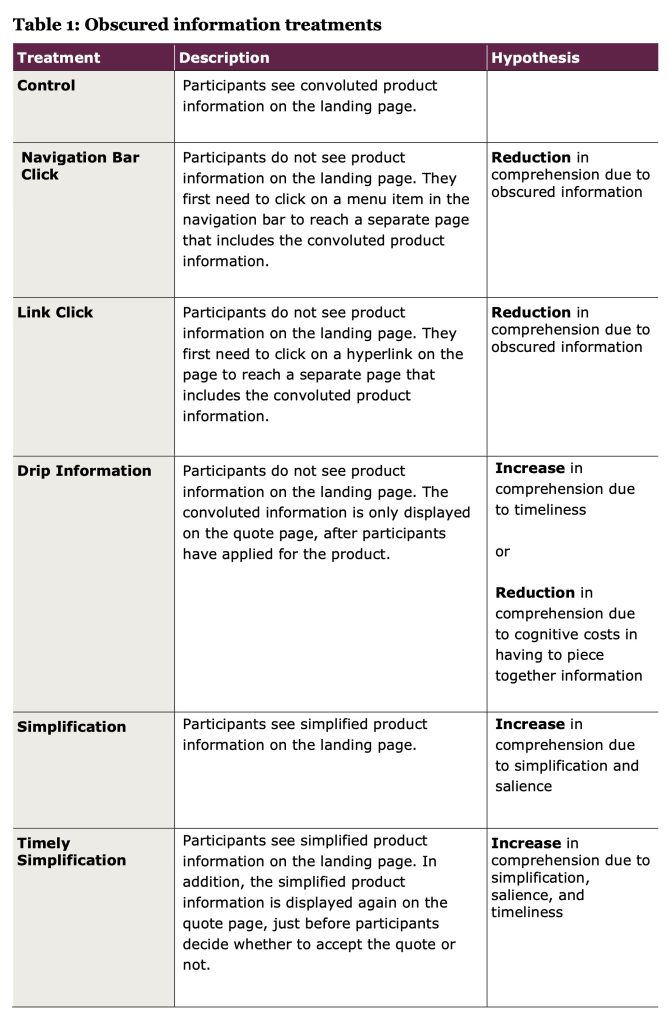

Academics conducted an online experience designed to investigate how differing presentations of information during a consumer credit customer journey affected participants’ comprehension of key product features and the actions they took. Specifically, the experiment tested the impact of obscured information, simplification, and the timeliness of presenting information.

The research found that obscuring information had a “strong effect” on comprehension of the financial product. Firms that require loan applicants to click to read product information should be especially concerned that they can document their clientsʼ understanding, given the research finding that “even just one click” can affect consumersʼ ability to make an informed decision.