Regulatory Reform

FCA unveils biggest overhaul of financial advice since RDR, questions remain

• 0 minute read

June 30, 2025

The Financial Conduct Authority (FCA) has announced the biggest overhaul of financial advice for UK consumers since its predecessor the Financial Services Authority’s Retail Distribution Review (RDR) almost 20 years ago.

Chancellor of the Exchequer Rachel Reeves said the FCA reforms would help working people make better long-term financial decisions, adding: “Too many people are missing out on the support they need.”

Sarah Pritchard, deputy CEO of the FCA, agreed that the changes would help consumers navigate their financial lives, saying the proposals were a “win-win” for consumers and firms alike.

The FCA is proposing, in consultation paper 25/17, the creation of a new targeted support regime. Consumers using targeted support would be eligible to bring complaints to the Financial Ombudsman Service (FOS) and for compensation from the Financial Services Compensation Scheme (FSCS).

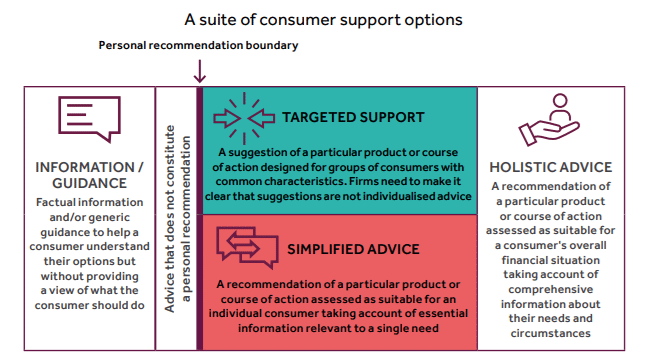

Targeted support will also introduce a fourth option for consumers seeking help with their savings, alongside information and guidance, simplified advice and full “holistic” advice (see graphic).

Online platforms Moneybox and InvestEngine were quick to welcome targeted support, with Brian Byrnes, head of personal finance at Moneybox, saying the proposals could help UK households increase their collective net wealth by £142 billion.

Andrew Prosser, head of investments at InvestEngine, said his firmʼs research had found that one third of people would “feel more comfortable investing if they had someone helping with decisions”.

However, it is unclear whether the UK’s biggest financial institutions will offer targeted support. When the RDR was being introduced, some of the biggest banks explored the idea of offering customers online guided journeys before ultimately deciding against it.

Banksʼ reluctance to offer products to customers in situations where they perceive there could be a risk of mis-selling was highlighted recently in testimony to Treasury Committee.

In the FCA consultation paper, question 38 asks respondents if they agree that targeted support should fall within the FOS compulsory jurisdiction, and question 42 asks if they agree that targeted support should be eligible for compensation claims to the FSCS.

Advice gap?

First announced in 2006, the RDR — which came into force in 2012 — significantly increased the professional qualifications required to offer financial advice to the public, and banned financial advisors from earning commission when selling investments.

Since then, the number of people seeking financial advice in the UK has dropped significantly. According to the FCA’s 2024 Financial Lives Survey, just 9% of adults took advice about pensions or investments in the previous year.

However, some question whether this constitutes an “advice gap”, as the FCA and politicians often claim. There are 7 million adults with £10,000 or more in cash savings. But as the Treasury Committee was told last month, many of those holding cash balances are pensioners.

“Around 80% of our balances are held by people who are either at retirement age or nearly at retirement age, and for a lot of people, investing in equities — which is a much longer-term, more complex decision — would not necessarily be right,” Debbie Crosbie, chief executive of Nationwide Building Society, told the committee.

The FCA published independent research alongside its proposals for targeted support, which it said showed 54% of savers would welcome some “help and support to decide whether to invest excess savings”. Meanwhile, 68% of those who already had investments would “welcome more help and support when reviewing investments to make sure they are right for them”.

Incentives

The FCA said the introduction of targeted support would not mean a return to the mis-selling of the pre-RDR period, and that it had proposed a “robust framework” for the new regime to “ensure targeted support services are of high quality”. The watchdog said commission would remain banned, and the Consumer Duty requirements for firms to ensure they identified clear target audiences for their products — and that consumers understood what they were buying — would apply.

However, it was not just commission that led to mis-selling of investment products in the past. Flawed sales targets also contributed to several banks being penalised. For example, in 2013 Lloyds was fined £28 million for “serious failings in their controls over sales incentives schemes”. In all, around 700,000 Lloyds customers were sold unsuitable investments.

Moreover, the 2013 fine was increased by 10% because it was the second time in a decade that the pressure to meet sales targets had led to mis-selling by the bank’s staff.

Part 4A permission

The FCA is proposing to create targeted support as a new regulated activity requiring a Part 4A permission. This will mean any firm seeking to offer targeted support — including those already authorised to provide investment advice — will have to apply for authorisation.

What the FCA will look for in applications for targeted support

• How a firm plans to identify customers who might benefit from targeted support.

• How firms plan to conduct initial segmentation of consumers.

• How firms intend to develop suitable ready-made suggestions which are consistent with the overall purpose of providing targeted support.

• How firms will check that consumers align with particular segments and can be offered ready-made suggestions.

• Evidence that firms have developed a clear end-to-end customer journey for targeted support and conducted testing to ensure it will operate as intended.

• Firms’ plans for ongoing checks to ensure their targeted support model continues to operate as intended.

• Evidence that firms have adequate systems and controls in place to deliver.

When reviewing authorisations for firms looking to offer targeted support, the FCA said that, among other things, it would “pay attention to” how firms identify customers for targeted support and evidence their customers journeys and outcomes (see box) as well as the “nature and volume of complaints” to the FOS.

The consultation closes on August 29.