Financial Crime

Jailed UK art dealer ignored due diligence platformʼs alert on Hezbollah financier

• 0 minute read

June 10, 2025

Jailed UK art dealer Oghenochuko Ojiri, who knowingly sold art to a sanctioned Hezbollah financier, subscribed to and used an art market due diligence platform. Ojiri did not heed an amber risk alert on a company connected to Nazem Ahmad, who was designated in 2019, a court heard last week.

Ojiri was jailed for two and half years at the Central Criminal Court in London on June 6, for failure to report suspicion of terrorist financing, in the only case of action taken against a UK art dealer in relation to anti-money laundering and combating the financing of terrorism (AML/CFT) reporting obligations.

Oriji was aware of Ahmad’s sanctioned status and had been alerted to the danger of dealing with him by an American partner, said Mrs Justice Cheema-Grubb in sentencing Ojiri to three and a half years for his offences. One year of the sentence will be served on licence.

“These offences are so severe that only a custodial sentence can be justified,” she added. “Working in a regulated sector brings responsibilities, but you closed your eyes to what you knew.”

Oijiri previously pleaded guilty to eight counts of failing to make a disclosure about transactions within the regulated sector, contrary to section 21A of the Terrorism Act 2000. Under the act, it is an offence if a person has knowledge or suspicion of offences related to terrorist financing and fails to disclose this knowledge or suspicion.

The judge emphasised there was no evidence that Ojiri supported terrorism or extremism.

Used Arcarta

Ojiri knew he was dealing with Ahmad, to whom he sold about £138,000 worth of art between October 2020 and December 2021. The court heard his computer’s web browser data showed the dealer accessed and read an article about Ahmad in the New York Times after he was sanctioned by the US Treasury in 2019. Hezbollah is a proscribed terrorist group in the UK.

Ojiri’s Ramp Gallery used Arcarta, an art market due diligence platform, to conduct checks on White Star DMCC, a Dubai company linked to Ahmad, the judge said during sentencing.

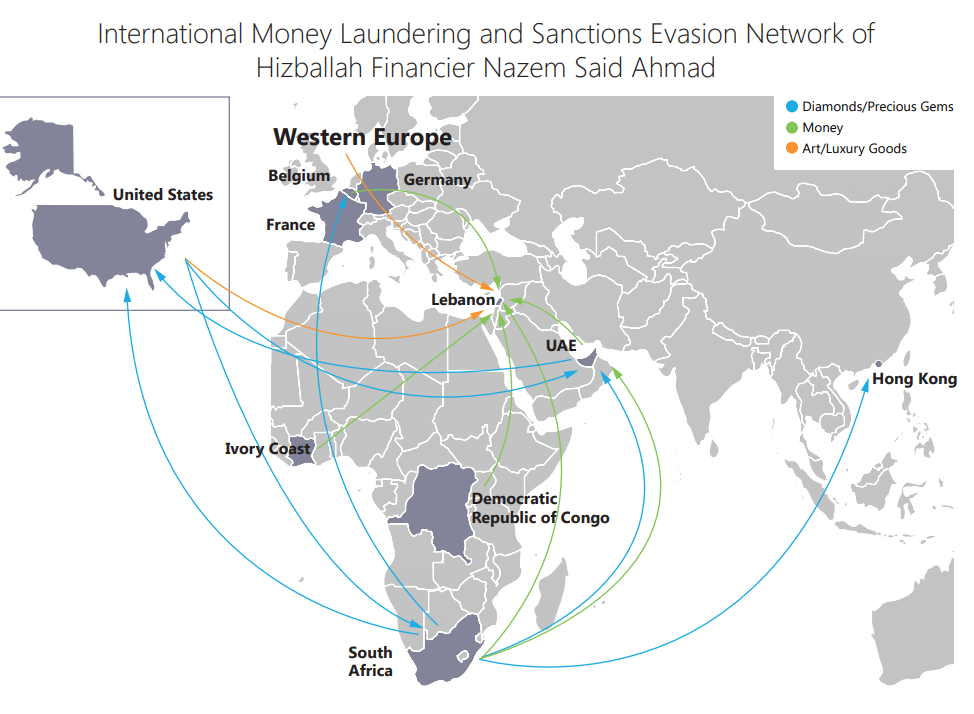

The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated White Star in 2023, as part of a large international money laundering and sanctions evasion network of 52 individuals and entities in Lebanon, the United Arab Emirates, South Africa, Angola, Côte d’Ivoire, the Democratic Republic of the Congo, Belgium, the UK, and Hong Kong.

Source: US Department of Treasury

Ojiri was aware of how suspicious activity reports (SARs) should be made and how Arcarta’s customer due diligence system worked. He said the Arcarta system “greenlighted” White Star — but that system flagged the company with an amber risk rating at the time he used it, the judge said.

In sentencing, she noted Ojiri had emailed the Arcarta support team on several occasions about compliance obligations. He knew the reporting requirements and had plenty of opportunity to submit SARs but made no reports, she added.

Ojiri’s barrister acknowledged Ramp Gallery used Arcarta, but said Ojiri did not use it properly, did not use it well and was not properly trained on the system.

Electronic evidence trail

The US Department of Homeland Security brought Ojiri’s involvement with Ahmad to the attention of UK law enforcement. The investigation by the Metropolitan Police, which included forensic analysis of Ojiri’s phone and computer, showed he communicated with Ahmad via Instagram, WhatsApp and email. Ahmad used a Gmail account, the court heard.

Communications between Ojiri and Ahmad discussed compliance with UK regulations and the need for corporate documents as well as individual identification. Ahmad sent Ojiri a woman’s identification documents. The pair exchanged messages about invoicing and billing. Ojiri changed invoices to obscure Ahmad’s involvement, the court heard.

After Ojiri’s arrest in April 2023, the Met subsequently obtained a warrant to seize several artworks belonging to Ahmad held in two UK-based warehouses, it said in a statement.

The artworks, valued at almost £1 million and including works by Picasso and Andy Warhol, were seized on May 4, 2023 and the Met’s National Terrorist Financial Investigation Unit (NTFIU) obtained a forfeiture order later the same year. They will be sold and the funds reinvested in UK law enforcement, the Met said.

New sanctions reporting rules

The UK’s Office of Financial Sanctions Implementation (OFSI) recently introduced additional rules making high value goods dealers and art market participants subject to financial sanctions reporting requirements. As of May 14, 2025 high value goods dealers and art market participants must complete enhanced due diligence on customers and report on cash transactions of over 10,000 euros. These requirements are in addition to the Terrorism Act 2000 obligations that widely apply, and existing obligations under the Money Laundering Regulations (MLR 2017).

The rules apply to dealers no matter the size of their businesses. The potential jail sentences — of up to five years — attached to breaking the rules have focused the minds for some in the market.

“Thatʼs serious. Thatʼs not just a fine for a company, thatʼs an individual criminal charge for not complying,” said Nicola Gifford, general counsel at AML technology platform SmartSearch in Leeds.

“[High value dealers] had to comply with the anti-money laundering regulations for quite a few years. Weʼve had companies on our books already,” she added. “What this additional regulation brings in is the actual teeth. If they do fail to act on the results of the customer due diligence that they do, there are consequences. And because there havenʼt been consequences before, the art dealers have thought, do I really need to do this?”

Smaller dealers should seek to support each other on compliance matters, potentially through a trade association, Gifford noted.