Europe, Middle East, Africa

New EMIR data quality indicators boost EU trade reporting supervision

• 0 minute read

June 19, 2025

A new set of data quality indicators for the European Market Infrastructure Regulation (EMIR) will give a further boost to the supervision of trade reporting in the European Union. The European Securities and Markets Authority (ESMA) recently published an updated set of specifications for its EMIR data quality dashboard of 25 data quality indicators (DQI), up from 17 last year and from 11 the previous year.

“The purpose of the dashboard is to enable continuous monitoring, on an objective basis, of the improvement/decline in the EMIR data quality on an EU level. Furthermore, the dashboard will assist [national competent authorities (NCAs)] and ESMA in proactively setting supervisory priorities, and will allowthe timely detection of any major irregularities in the reporting,” ESMA said.

ESMA is using EMIR DQIs to share “granular” information with NCAs about reporting firms’ accuracy and quality, to inform supervisory activity. It allows the regulator to zero in on problematic firms no matter their size or significance, according to Tim Hartley, EMIR reporting director at Kaizen, a regulatory reporting specialist company in London.

“It’s no longer the case that the NCA is going to target the big sell-side bank or the large hedge fund that’s doing a lot of daily trading, for example. They’re looking at firms that breach these data quality indicators regardless of size,” said Hartley.

“So you could be big, you could be small — but if you trigger these data quality indicators, then that will get your NCA’s attention and they’ll start asking you questions about your regulatory framework, how your reporting works, what checks and balances you’ve got in place — and you’ve got to have the right answers to those questions.”

Monthly updates

Indeed, the dashboard will be calculated monthly, and where serious data quality emerges, ESMA will share it with EU NCAs to follow up with the relevant reporting entities. ESMA will also pass on data about entities whose reports comprise at least 1% of all incorrect reports.

“The other thing is that they know that if they trigger these data quality indicators, then the regulators start asking other questions,” Hartley said. “It is a gateway to question other parts of a firm’s reporting. What else has this firm got wrong? What else does the firm not understand aboutreporting if they don’t even have their collateral and valuation reporting being done properly under EMIR?

“Firms should target those areas where they’re triggering DQIs and prioritise their remediation accordingly,” he added.

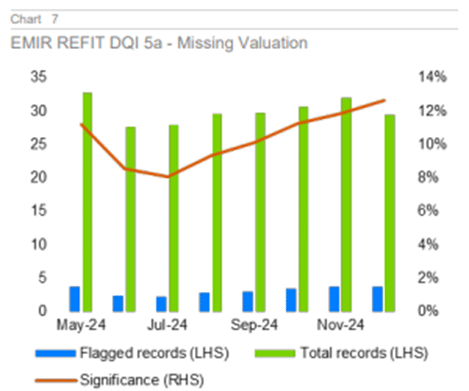

In its most recent data quality report, ESMA published comments about five DQIs to show positive and negative trends. One DQI it chose to highlight was 5a, showing reports with missing valuations trending upwards. As of December 21, 2024, this indicator stood at 12.63%. ESMA said it will closely monitor it, because “the absence of data in this crucial field directly impacts authorities’ ability to monitor exposures accurately”.

Firms want to benchmark

One year on from the EMIR Refit application date — which marked the third major change to the regime since its February 2014 debut — firms are still focused on what Hartley calls the “day two book of work”. That is the quality assurance aspect— ensuring trade reports are accurate and fit for purpose.

But what firms also want to know is where their competitors sit with their reporting efforts, and whether other firms struggle with reference data or follow the complex set of reporting rules and guidelines.

“It’s that benchmarking that really gets firms excited. Even though I want them to be excited about the assurance testing and say ‘our notional looks too big for this trade, we should do something about that’, they’re much more interested in those benchmarking reports that we give out because if they’re good, they get that nice warm fuzzy feeling,” Hartley said.

“Or it can be the total opposite, if a firm is at the bottom of the list. Then they know they’re in a bad spot.”