UK Regulation

Targeted support integral to ISA overhaul, says City minister

• 0 minute read

April 30, 2025

Savers will need support to shift money into investments, Emma Reynolds, economic secretary to HM Treasury, told lawmakers last week, adding the government was “very interested in boosting the culture of retail investment”.

Giving evidence to the Treasury Committee on April 23, Reynolds said the government was carefully considering “targeted support” for savers alongside its review of tax-incentivised Individual Savings Accounts (ISAs). This would involve financial services firms “being able to suggest to clients with a similar set of characteristics certain things that they could do with their money, without putting any pressure on them, that would make sense in their financial circumstances”.

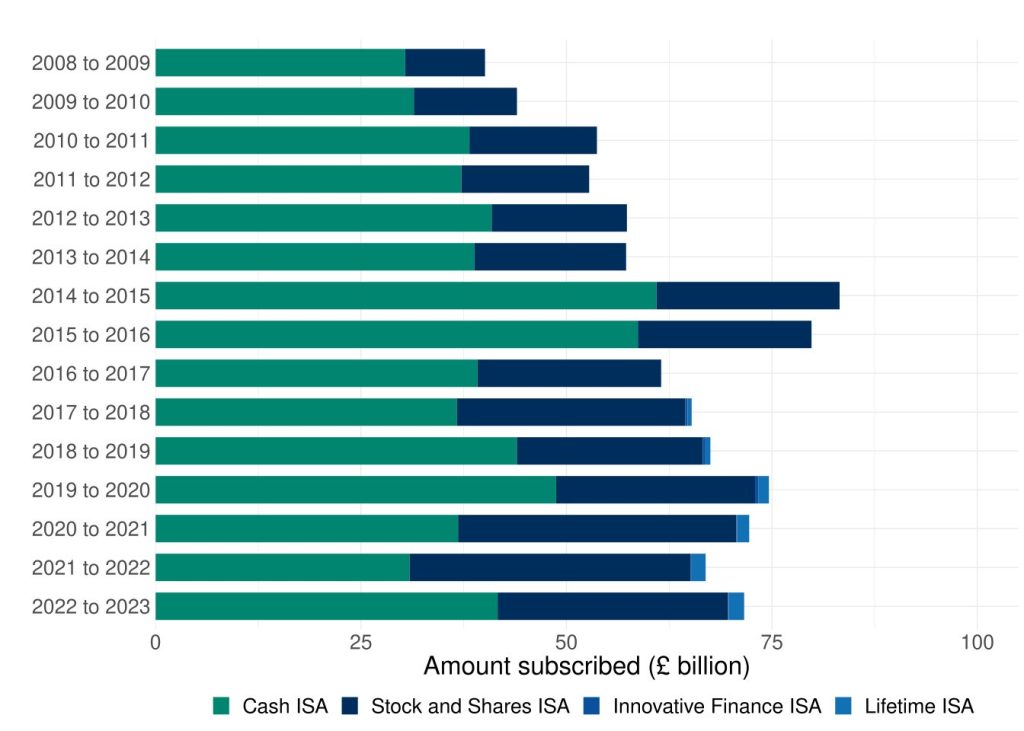

The most recent data, for 2022-23, shows that 12.4 million people opened an ISA, up from 11.8 million the previous year, and 63% of all those opening accounts opted for a cash product. There are six types of ISA: Cash; Child; Help to Buy (no longer available to new customers); Lifetime; Stocks and Shares; and Innovative Finance.

Inquiry into LISAs

The Treasury Committee is holding an inquiry into Lifetime Individual Savings Accounts (LISAs), a hybrid tax-incentivised savings product introduced in April 2017 and designed to help the under-40s save for a first-home deposit. If the money is not used to purchase a property it rolls over as a retirement savings pot, which can be accessed at age 60.

In 2023-24, 57,000 individuals used LISAs to buy a home, withdrawing an average of £15,000 from their accounts.

LISAs have their critics, partly because the value of a property that can be purchased with a LISA is capped at £450,000 and partly because the productʼs retirement element has led many high street banks to omit them from their ISA range, for fear of future mis-selling claims.

Giving evidence to the inquiry in February, Martin Lewis, founder of Money Saving Expert, said first-time buyers using the money amassed in their LISA accounts to purchase a property valued over £450,000 faced a withdrawal penalty.

“The problem with the lifetime ISA that we all need to recognise is the penalty for withdrawal. I have no problem with the withdrawal penalty in its own right. I have a problem with it for first-time buyers buying a house,” said Lewis.

“We have a succession of young people who are saving in the vehicle they have been encouraged to save in by the state, who are then trying to use their savings to buy a first-time property but, due to house price inflation, their property has just tripped above the £450,000 level.

“Then, not only do they not get the £1,000 a year bonus they were intended to get, which I understand is legitimate as a threshold, but they are fined by the state — effectively 6.25% of their own money — in order to withdraw that money to get the cash out.”

ISA review

Reynolds said the government was looking “in the round” at ISA products, and at how it could “drive better returns for savers” while supporting its “ambition to drive greater economic growth”.

Regarding speculation that the government was considering reducing the annual cash ISA limit from £20,000 to £5,000, Reynolds said no decisions had been made about any of the ISA products, or their limits.

FCA sprint

Hargreaves Lansdown is one of the 12 firms that tested a prototype in the Financial Conduct Authority’s (FCA) “targeted support” sprint. In an earlier evidence session, Anne Fairweather, head of government affairs and public policy at the investment platform, told the committee that the group’s prototype was designed to help people build confidence to move from saving in cash, to investing.

Richard Stone, chief executive of the Association of Investment Companies (AIC), said greater financial education on investment was needed. He was the only witness who thought the cash ISA should be scrapped. “There are lots of other incentives to saving cash already,” Stone said, during the hearing on February 26.

Meanwhile, at the April 10 showcase for the targeted support sprint, Sarah Pritchard, FCA executive director for consumers, competition and international, urged firms and consumer groups to “keep engaging” with the regulator on its review of the advice guidance boundary.

“We want to see a consumer investment market where people can invest with confidence, understanding the risks and opportunities available to them. The sprint is an important step to achieving that goal, helping firms explore ways to support consumers and helping the FCA to refine the proposed policy framework before consultation. We look forward to seeing more innovative solutions emerge,” she said.

The FCA did not respond to a request for further details on the participants or prototypes tested in its sprint.