Europe, Middle East, Africa

UAE overtakes UK to clinch second spot in fintech H1 2025 fundraising rankings

• 0 minute read

July 24, 2025

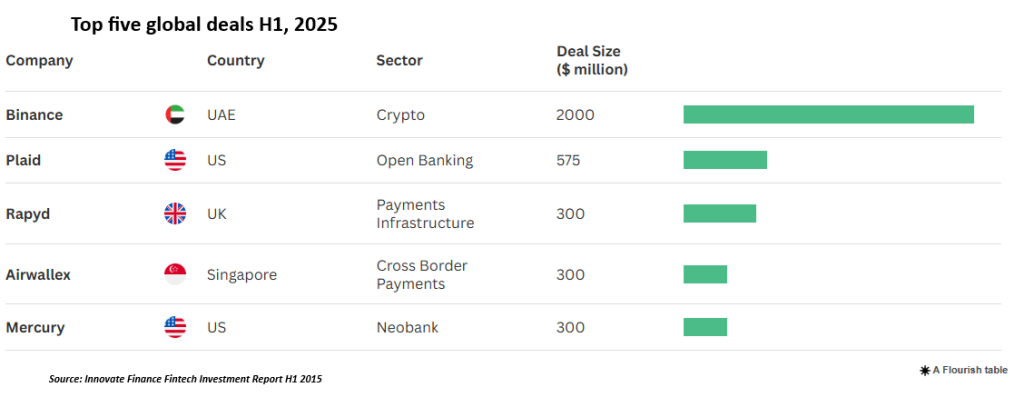

Binance’s $2 billion March fund raising has lifted the United Arab Emirates (UAE) into second place in the fintech investment league table for the first half of 2025. In all, the UAE notched up total fintech investment of $2.2 billion.

As ever, the US led the way in the rankings, attracting $11.5 billion — though investment was down 1% on the second half of 2024, according to the FinTech Investment Landscape report, published today.

The UK, which was pushed into third place by the UAE, saw total investment in fintechs remain flat in H1, at $1.5 billion.

Innovate Finance, which produced the report, has been calling for an overhaul of UK regulation to boost fintechs for some time. Among the industry bodyʼs requests was the concierge service for scale-up firms. The government announced that the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) will being offering concierge support services alongside the Leeds Reforms last week.

Innovate Finance CEO Janine Hirt said that the government and regulators must continue to work with industry in order for the UK to maintain its global lead in the sector.

“The UK fintech sector has proven its value,” she added. “It is profitable, job-creating and globally recognised — 11 of the UK’s most profitable fintechs alone reported combined profits before tax of $3.3 billion in 2024 and employ over 26,000 people.”

UK-wide, the sector employs around 82,000 people, according to tracking company The Data City.

Top five

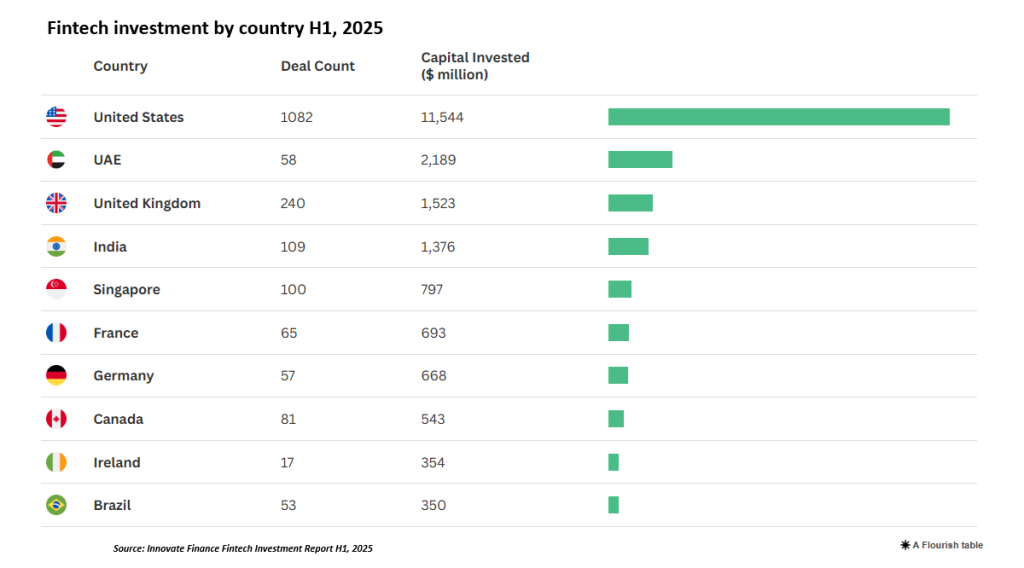

Globally, there were 2,597 investments into fintech firms in the first six months of 2025, worth a combined $24 billion — up 6% on the last six months of 2024. The US completed 1,082 deals.

The UK completed 240 deals, but these attracted less investment than the UAEʼs 58 deals. Fourth-placed India is also catching up on the UK in terms of investment volume and deals, at $1.3 billion and 109 respectively.

Singapore beat France and Germany to take fifth place, completing 100 deals worth a combined $800 million.

Sector breakdown

Payments firms executed the most lucrative deals in H1 2025, reflecting both the high growth nature of the sector and the capital required to “build out a successful payments business”, according to the report.

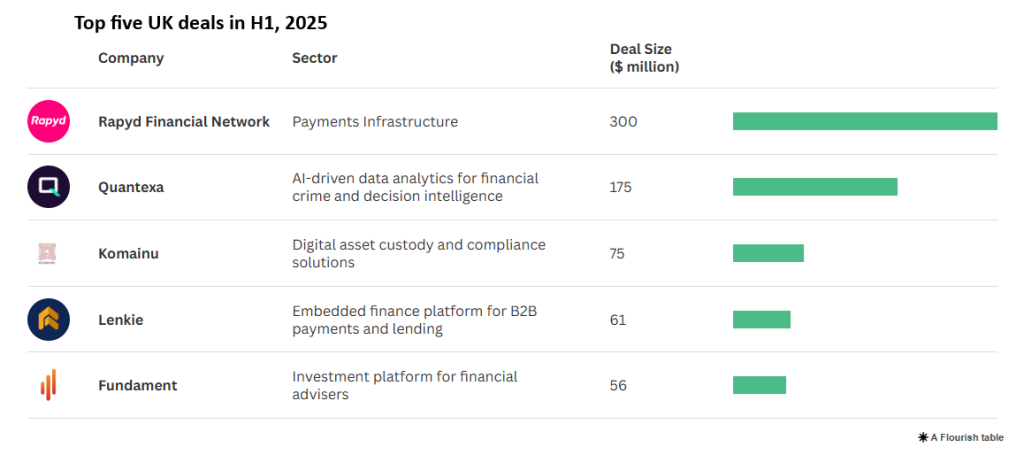

In the UK, payments infrastructure group Rapyd secured the most investment ($300 million), followed by artificial intelligence (AI)-driven financial crime analytics firm Quantexa ($175 million) and digital asset custody and compliance group Komainu ($75 million).

Rezso Szabo, general partner and head of London at venture capital firm Illuminate Financial, said it had been a difficult six months for fintechs looking to raise finance outside “specific sub-themes within AI and digital assets”.

During a webinar marking the launch of the report, July 24, Szabo said the UK is suffering from not having developed an AI infrastructure.

“We don’t really have a big infrastructure business out of the UK like France has Mistral, at least on the LLM side. I think secondly, there is also an engineering ecosystem that comes with that, and we are seeing a very collaborative environment in Paris right now , where startups are helping each other [where] those who have made it contribute back to the ecosystem through angel investment. And also a lot of talent is moving back from the United States to France,” he said.

James Codling, managing partner at venture firm Volution, attributed the constrained UK market to a lack of liquidity among venture capital firms. “That means fewer new investments are being made, and those that are tend to be concentrated in a smaller set of high-conviction deals. The market is in a bit of a holding pattern — waiting for liquidity to improve and confidence to return,” he said.

Venture capital firms have two main routes to free up capital from their existing investments: trade sales and initial public offerings (IPOs). The UK government has eased listing rules in an effort to encourage more firms to list in London.

It has also backed the PISCES (Private Intermittent Securities and Capital Exchange System) hybrid public-private market, which will allow intermittent trading in the shares of private companies.

Speaking during the webinar Neil Shah, head of tech & tech-enabled sector, primary markets at the London Stock Exchange, said “PISCES is a pressure release valve that will hopefully allow these companies to offer a little bit of liquidity to founders, to employees …And it prevents premature sale or premature IPO and allows companies that agency to transact when it makes sense for them.”

Shah said that that LSE hoped to get approval from the FCA by the end of Q3 and carry out its first transactions by the end of 2025.

The Leeds Reforms also included an announcement that leading asset managers, investment platforms and the London Stock Exchange Group will fund a campaign to educate the UK public on investment.