Retail

UK government told reducing cash ISA limit may not shift savings to investment

• 0 minute read

May 30, 2025

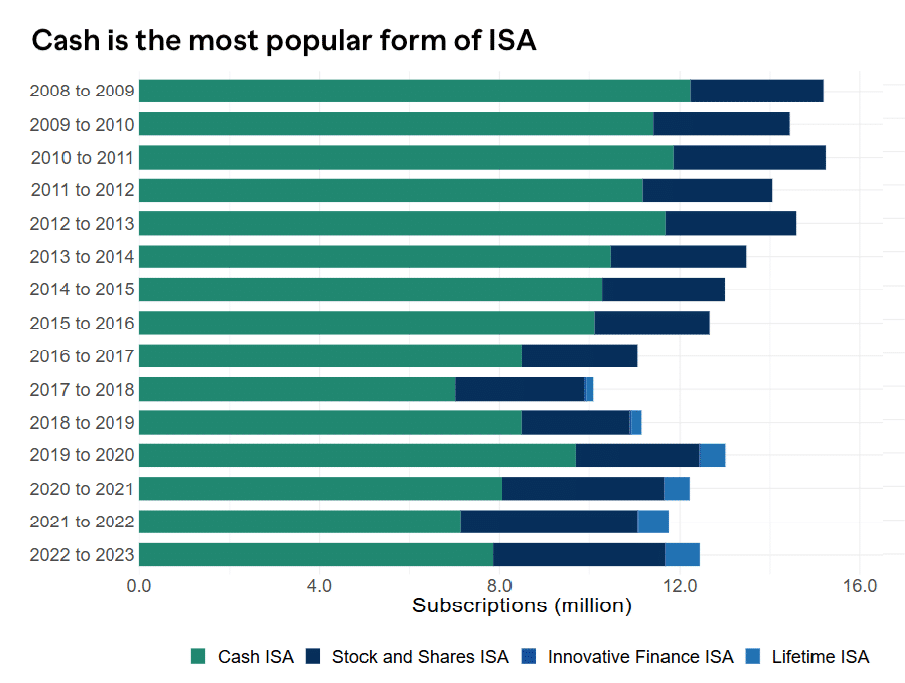

Chief executives at some of the UK’s leading banks and building societies cautioned the government last week that reducing the current £20,000 annual limit on cash ISAs might not lead to a wave of money being moved into investments.

Their warning comes as a leading industry figure called for a national advertising campaign, funded by the asset management industry, to be rolled out to help educate the public on the long-term advantages of investment over cash savings.

Nationwide Building Society chief executive Debbie Crosbie said cash savings were really important to people’s financial resilience, and that shifting to investments might not be appropriate for the majority of her customers because of their life stage.

“We find that around 80% of our balances are held by people who are either at retirement age or nearly at retirement age, and for a lot of people, investing in equities — which is a much longer-term, more complex decision — would not necessarily be right,” said Crosbie, giving evidence to the Treasury Committee on May 21.

Stuart Haire, chief executive of the Skipton Building Society, agreed with Crosbie that cutting cash ISA limits might not prompt savers into investing money instead.

“From research that we did, over 60% of customers who have cash ISAs are aware of the construct of an equity ISA, yet they still choose to stay in a cash ISA. The reason for that is often to do with their individual circumstances,” Haire said.

“They may be saving for a specific item and need access to the cash, or they may be towards the tail end of their retirement and therefore, again, do not want to tie up capital in equity longer-term investments.”

Barclays Bank chief executive Vim Maru told the committee that there were also psychological “barriers” to overcome in persuading cash savers into investment.

Barclays has around £430 million sitting in cash ISAs and savings accounts. But the bankʼs research had found the issue was not just about people gaining access to appropriate advice but also that “at the moment, a lot of people think ‘this is gambling’”, Maru said on May 20.

“From the research that we have done with our customers, many of them think of investing as gambling, so we will have to build more campaigns around the culture of investing so that people start to understand the benefits of it, as well as the risks,” he added.

Public campaign

A public information campaign to educate UK savers on the merits of investing over the longer term should be funded by the asset management industry, according to Robin Fieth, chief executive of the Building Societies Association (BSA).

Speaking earlier this month at the BSA 250th anniversary conference in Birmingham, Fieth said the government should leave the cash ISA limit at £20,000 and instead support a public information drive modelled on a successful New York Stock Exchange (NYSE) campaign.

“If the intention is that we want more UK citizens to invest in the stock market, then thereʼs a really good proposal around for an intensive campaign, and the most compelling case study in history. It was the New York Stock Exchange in the 1950s, who ran a 16-year campaign that shifted US citizens away from putting everything in cash,” Fieth said.

His preference would be for fund managers to pay for the campaign through the London Stock Exchange (LSE), “not the government”, he added.

A key driver behind the NYSE “ Own Your share of American business” campaign had been to reassure and educate US citizens that investment was not gambling, after the 1929 stock market crash dented their faith in equities.