Operational Resilience

UK’s largest banks paid customers £6.2 million after IT outages; January incident could see this double

• 0 minute read

March 6, 2025

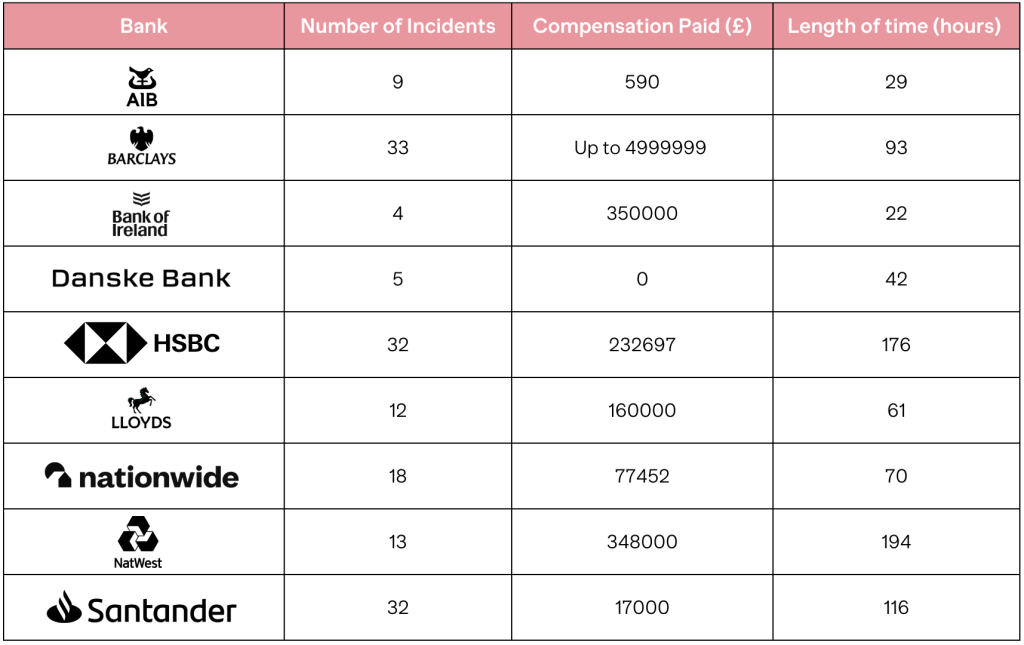

The UK’s largest nine banks collectively paid their customers £6.2 million following IT failures in the past two years, according to data released by the Treasury Committee today. The total compensation bill looks set to double, however, after Barclays said it expected to pay a further £5 million to £7.5 million in compensation following the outage it experienced at the end of January, which was tax filing deadline day in the UK.

“We continue to work through the impact to ensure no customer or client will be out of pocket as a result of the incident,” Barclays UK CEO Vim Maru said in a letter dated February 26, but published this morning.

The information is contained in a series of letters published by the Treasury Committee following an information request issued by the committee last month to Allied Irish Bank, Bank of Ireland, Barclays, Danske Bank, HSBC, Lloyds, Nationwide, NatWest and Santander.

Only Danske Bank has not paid any compensation to its customers, according to information contained in the letters.

In all, the banks suffered “at least 158 IT failure incidents” since January 2023, excluding the most recent outages that occurred at the end of January and February 2025. These 158 outages left customers unable to access banking services for a total of 33 days.

“The fact there has been enough outages to fill a whole month within the last two years shows customers’ frustrations are completely valid. The reality is that this data shows even the most successful banks and building societies hit technical glitches. What’s critical is they react swiftly and ensure customers are kept informed throughout,” said Treasury Committee chair Dame Meg Hillier, in a statement issued alongside the bank’s letters.

Hillier said she was thankful some banks had seen fit to “compensate their customers well” for the stress they experienced during outages, adding that she would “encourage all to reflect on whether they were doing enough in that regard”.

Cause of failures

The banks have all set out — some in considerable detail — the reasons for each outage that occurred, along with the business channels that were affected. These included failure of third-party suppliers, internal software malfunctions and disruption caused by system change.

John Cronin, founder of research and analysis firm SeaPoint Insights, said outages happen “too often”, raising the perennial question of whether banks were investing enough in systems.

David Raw, managing director of operational resilience at industry trade body UK Finance, said banks were investing billions in systems and technology to “ensure customers have easy and convenient access to their money across a range of channels”.

This investment meant incidents that caused significant disruptions were rare, he added, but “unfortunately there are occasions when some services are unavailable, and we recognise this can cause inconvenience for customers”. When such incidents occurred, banks worked hard to restore services as quickly as possible, he said.

Writing at the weekend, Cronin acknowledged that the banks had “ploughed large sums” into their technology in recent years but said traditional lenders remained at a “significant disadvantage” to digital-only banks in an operating modal context.