Cryptocurrency Regulation

US CFTC: regulators must not ‘Dodd-Frankʼ the crypto sector

• 0 minute read

July 7, 2025

US regulators should avoid applying Dodd-Frank Act styled rules on the crypto sector, head of the US’s primary commodities regulator said last week.

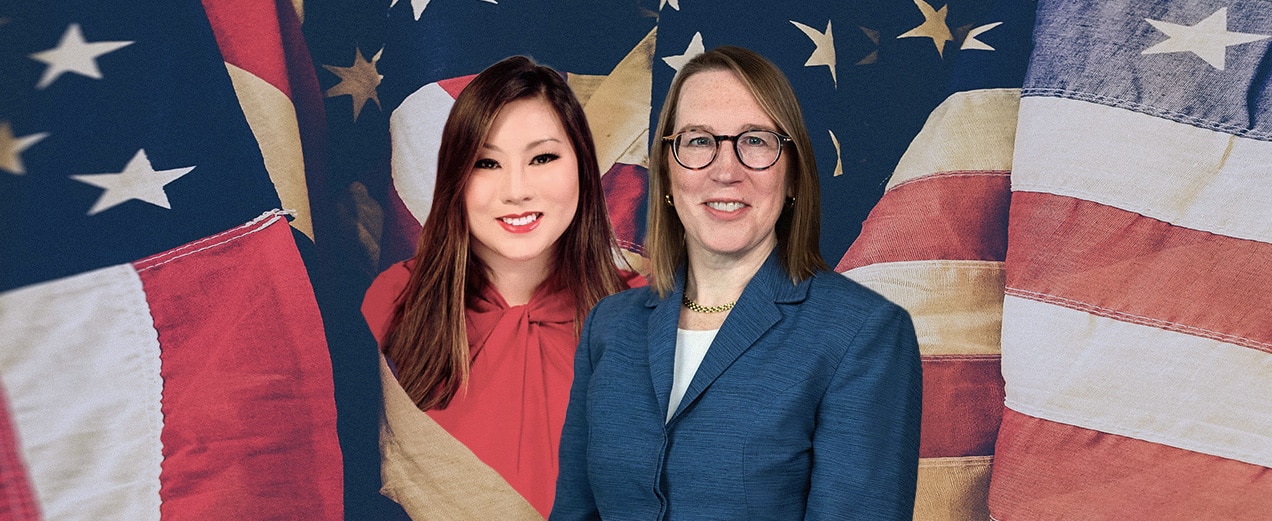

“Iʼd very much like us to not repeat the mistakes of the past,” said the US Commodity Futures Trading Commission (CFTC)’s acting chairman, Caroline Pham, at City Week 2025 in London on July 2.

The US brought in the Dodd-Frank Act after the 2008 global financial crisis, in an attempt to deal with contributing factors, such as lack of oversight and transparency, and heavy leverage. Its key provisions included granting authorities powers to wind down failing financial firms and establishing the Consumer Financial Protection Bureau (CFPB).

Pham characterised the “two great lessons” from the Dodd-Frank Act as a “regulatory moat” and “market fragmentation”. She highlighted that crypto regulations should encourage “direct access” into the market, particularly through market structure and innovation measures.

Similarly, US Securities and Exchange Commission (SEC) commissioner Hester Peirce also held that allowing “innovation” is key to “investor protection”. Speaking at the same event, she said: “The best way to protect investors is to make sure that marketplaces are dynamic.

“People who are not doing a good job at serving investors [should] fail and exit the market,” she said. “And new entrants who have better ideas about how to do things, should be able to get in without undue regulatory barriers to entry.”

No “burdensome” regulation

Pham added the Dodd-Frank Act had too many “duplicative, costly, burdensome and sometimes unnecessary” registration, compliance and reporting requirements, and overreaching regulations meant only “big tech” would be allowed into the crypto market.

Meanwhile, market fragmentation emanated from compliance and risk management frameworks.

“I used to oversee a billion-dollar compliance programme that required 1,000 full-time employees. How many firms can realistically match that scale? This dynamic drove consolidation in the industry. [This] in turn can lead to concentration risk and broader threats to financial stability.”

Pham added that the US will be moving towards “a substitute compliance or mutual recognition regime”, rather than the more aggressive approach to enforcement favoured by former SEC chairman Gary Gensler.

Enforcement models

Peirce also criticised the “reliance on enforcement” of previous regimes, which had been used as a “blunt instrument” over the years, to bring order to the crypto space.

“It often just added to the confusion — especially since the rules themselves weren’t clear. It created a sense of arbitrariness, which undermines trust in the system,” she added.

Meanwhile, Pham said “a decentralised finance (DeFi) protocol itself is essentially software” from an enforcement perspective. This means the operator of a platform — who provides access to financial services on that software — should be the one with “proper authorisation”.

“For example, many people do illegal things on the internet, but the internet itself is not illegal. It’s the illegal actions that are illegal, regardless of the platform,” said Pham.

She further emphasised that “copyright, trademark and intellectual property rights” are helpful models for enforcement: “Think [music file-sharing app] Napster with Hollywood and the music industry. That’s a useful precedent for how we can approach enforcement in the DeFi space.”