Digital Assets

In a digital-first age, understand how robust regulatory oversight ensures that digital assets do not become tools for fraud, money laundering or market manipulation.

AllArticles

52 results

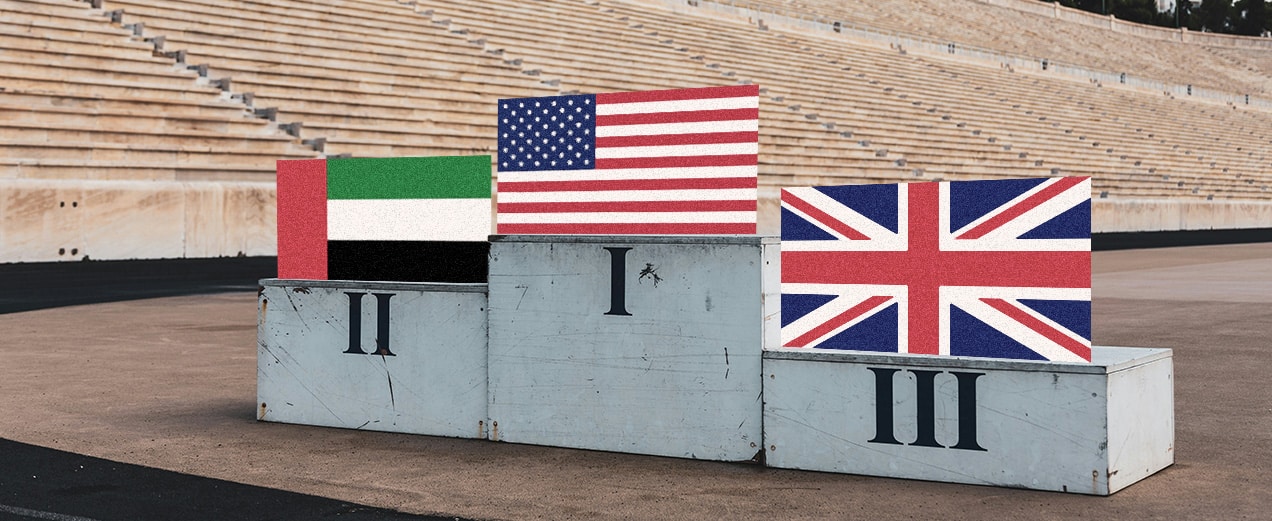

Europe, Middle East, Africa

UAE overtakes UK to clinch second spot in fintech H1 2025 fundraising rankings

Binance’s $2 billion March fund raising has lifted the United Arab Emirates (UAE) into second place in the fintech investment...

Tokenisation

Tokenised real estate accelerates with ‘green lightʼ from Dubai regulator

The United Arab Emirates (UAE)’s tokenised real estate sector has received a boost from Dubai’s Virtual Assets Regulatory Authority (VARA)....

Americas

US ‘Crypto Week’ post-match round-up: after GENIUS Act crossed finish line

The US House declared July 14-18 would be “Crypto Week” in a bid to advance three crypto-related legislative bills. Lawmakers...

Asia Pacific

Hong Kong leads stablecoin frontier; Shanghai regulator explores options

With its upcoming legislation and a joint initiative with South Korea, Hong Kong is taking the lead as a stablecoin...

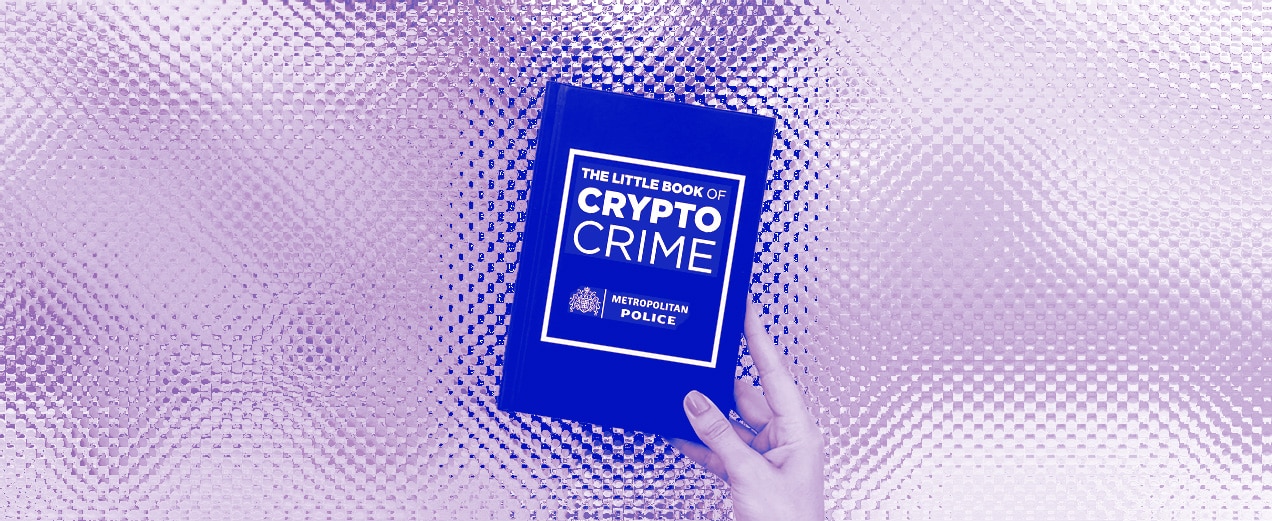

Financial Crime

Boom time for crypto-enabled fraudsters

Illicit activities have tarnished the growth of cryptocurrencies, and it’s a challenge for law enforcement to keep up with the...

Tokenisation

Tokenisation is not ‘free pass’ into the EU market

Robinhood’s latest “stock tokens” offering has raised questions over how they comply with EU regulatory obligations, such as the Markets...

Tokenisation

Regulator seeking clarification on Robinhood’s EU stock token launch

Robinhood is pushing up against regulatory boundaries with its newly launched “stock tokens” in the European Union market. The neo-broker...

Cryptocurrency Regulation

US CFTC: regulators must not ‘Dodd-Frankʼ the crypto sector

US regulators should avoid applying Dodd-Frank Act styled rules on the crypto sector, head of the US’s primary commodities regulator...

...